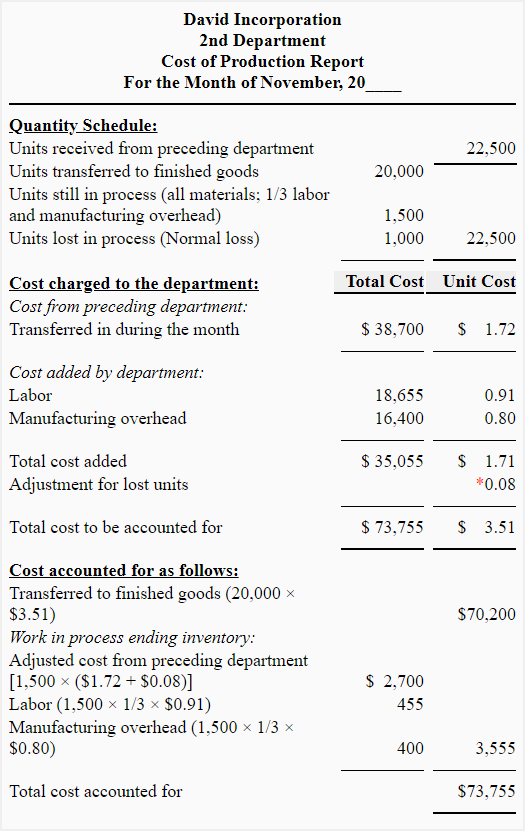

Exercise 10: Cost of production report of 2nd department

Pin Up Casino Online Slots Revie

28 Settembre 20221XBET Mobile APK Smartfon proqramını yükləy

28 Settembre 2022Exercise 10: Cost of production report of 2nd department

Maintenance costs are all the costs related to the activities in your maintenance schedule. This metric helps production managers monitor the performance of a machine over time with the goal of optimizing equipment availability while keeping costs at a minimum. Maintenance unit cost is the total maintenance expenses required to produce one product unit during a specified period. To calculate maintenance costs, divide the total maintenance costs in a specific time frame by the number of products produced during that same time frame. Conversion costs refer to the direct labor and manufacturing overhead expenses incurred in the production process to convert raw materials into finished goods.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- However it is recommended to use job order costing for more than one product.

- The production cost report for the month of May for the Assemblydepartment appears in Figure 4.9.

Do you already work with a financial advisor?

Now, check your understanding of the second or subsequent stage of a multi-step process using the weighted-average method of process costing. Production reporting is only one part of the larger production management process. For readers who care to go deeper into the subject, our site is an online hub for all things project management. We publish blogs, tutorial videos, free templates and more that address every aspect of managing a project and as it applies to many different industries. Here are a handful of links to stories about production management in manufacturing.

What is your current financial priority?

This report is used to determine the cost of goods sold and to determine the value of inventory. The cost of production report is commonly used in process costing systems where goods are produced through a series of processes and not produced individually. From the accounting records, we see that total direct materials used in January by the baking/packaging department were $600, and direct labor and manufacturing overhead totaled $4,100. We divided those amounts by the related Equivalent Units to come up with a cost per EU. From the accounting records, we see that total direct materials transferred to the mixing department in February were $3,575 and that direct labor and manufacturing overhead totaled $3,640. The company had 750 shells in process at the close of business on January 31.

Cost of Production Report (CPR) Questions and Answers

You have goals to provide the best possible product or service to your customers. Preparing the Production Cost Report for subsequent departments is similar to preparing the report for the first department, with the addition of a column for costs transferred in. In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory.

This formula can be a great way to find out how much it costs to produce a single unit, which can allow you to break down your production costs further. It’s also important to recognize that simply reducing production costs won’t necessarily generate more profit. There’s always a need to have certain raw materials and labor to ensure your product or service is high-quality. Factory overhead’ is a term used in business management for expenses related specifically with the cost of maintaining the premises, plant and equipment within a factory. Factory overhead costs may include items such as electricity, heat, power, rent, Depreciation on machines or even the supervisor’s salary. Costs not included with factory overhead are selling costs and general administrative expenses.

Table of Contents

However it is recommended to use job order costing for more than one product. Doing proper calculations will help with decision-making and increase business sales. You can find new opportunities charitable contributions and your taxes and areas for improvement so you can operate at an optimal level. Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University.

The beginning inventory of 750 plus the 3,250 pie shells worth of materials placed into production during the month gives us 4,000 total units to account for. Production volume measures how many units are manufactured over a specific period. This is a fundamental benchmark for manufacturing efficiency and helps production managers understand the total output the factory can produce. The production volume to be manufactured by an organization should be determined by its production budget. You can determine production costs by adding together any labor costs and direct material costs.

They are static documents that require manual updates and are poor collaborative tools. Upgrading to project management software provides greater control over production and, therefore, increases efficiency. ProjectManager is award-winning project and portfolio management software that can help manage resources and monitor costs and more to identify weaknesses and improve efficiency.

Basically, it’s how much it costs you to produce a single product or service, or the cost per unit. When you add together both the variable costs and fixed costs they’re going to equal the total cost. Essentially, this is the total cost incurred for production including any changes to production volume.

Notice that each section of thisreport corresponds with one of the four steps described earlier. Weprovide references to the following illustrations so you can reviewthe detail supporting calculations. Understanding how business production costs work is a critical part of any type of company. It’s going to impact everything from the suppliers you use to the type of product or service you produce.

Use our secure timesheets to ensure that labor costs align with the budget. Not only do they streamline payroll, but they provide visibility into how far each team member is in completing their tasks. For a high-level overview of production costs, use the real-time dashboard. Scheduling production, planning a budget and allocating resources only sets up manufacturing for success.