Chart of Accounts: Definition and Examples

Как Работает Букмекер Mostbet Что Предлагает Игроку Mostbet Официальный Сайт

14 Giugno 20221xBet Azərbaycan: rəsmi saytın nəzərdən keçirilməs

16 Giugno 2022Chart of Accounts: Definition and Examples

Trying to navigate your finances without a good Chart of Accounts (COA) is similar to this situation. I have primarily audited governments, nonprofits, and small businesses for the last forty years. So, let me summarize and say once more what the accounting sequence is. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Helpful resources for small businesses:

Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. No, but it’s considered necessary by all kinds of companies seeking to categorize all of their transactions so that they can be referenced quickly and easily. This coding system is important because the COA can display many line items for each transaction in every primary account. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. At the end of the year, review all of your accounts and see if there’s an opportunity for consolidation. Here’s how to categorize transactions in QuickBooks Online and navigate the COA.

What is the standard chart of accounts?

Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging. Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances. A well-structured COA provides a comprehensive view of financial activities, enabling detailed analysis for informed decision-making.

Financial Statement

- A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University.

- He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

- The purpose of the code is simply to group similar accounts together, and to provide an easy method of referring to an account when preparing journal entries.

- Because transactions are displayed as line items, they can quickly be found and assessed.

- This is crucial for providing investors and other stakeholders a bird’s-eye view of a company’s financial data.

For example, we often suggest our clients break down their sales by revenue stream rather than just lumping all sales in a Revenue category. By doing so, you can easily understand what products or services are generating the most revenue in your business. If you create too many categories in your chart of account, you can make your entire financial reports difficult to read and analyze. There are five main account type categories that all transactions can fall into on a standard COA.

Chart of Accounts Types

In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. Assets are resources your business owns that can be converted into cash and therefore have a monetary value. Examples of assets include your accounts receivable, loan receivables and physical assets like vehicles, property, and equipment.

Below, I explain what a chart of accounts is and how you will use it in bookkeeping and accounting. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. If you have Xendoo, you get Quickbooks and a team of expert bookkeepers and accountants to create your chart of accounts for you.

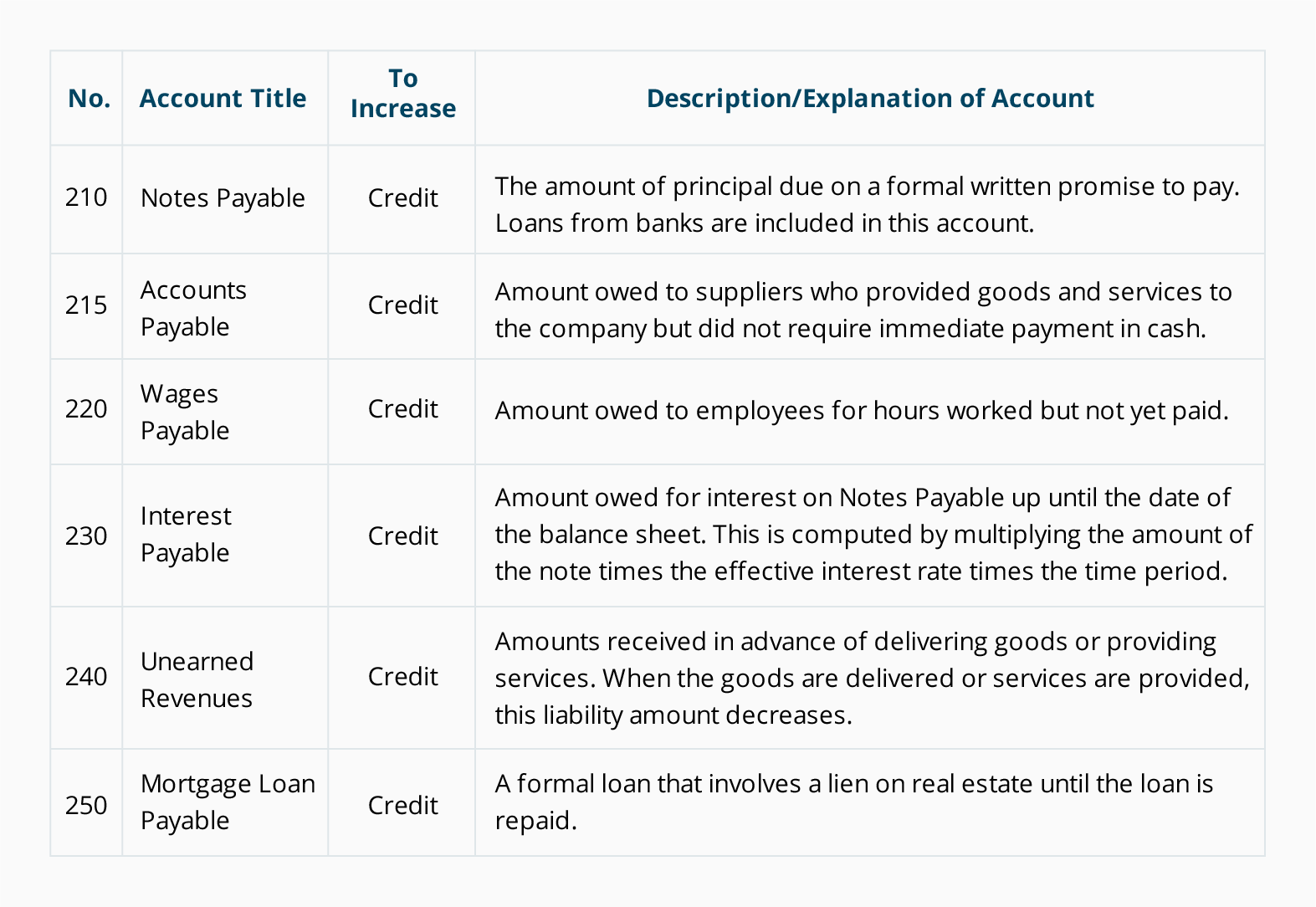

Want to turn your accounting into a powerfull business management tool? Consider integrating it with all your sales sources and payment systems to create a single source of truth about your business finances. Book your seat at our free Weekly Webinar of try Synder for free to see how it can help you manage your business more efficiently. If you remember those large accounting books of old times where you would write all the transactions, like how much you sold, earned, spent, and so on – that’s what the general ledger is. The only difference is that today, you don’t need pen and paper (or quill and paper, though I like that idea) and use accounting software (or any other electronic means of accounting) to do your books. Liability accounts usually have the word “payable” in their name—accounts payable, wages payable, invoices payable.

The first digit in the account number refers to which of the five major account categories an individual account belongs to—“1” for asset accounts, “2” for liability accounts, “3” for equity accounts, etc. A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. In addition, the operating revenues and operating expenses accounts might be further organized by business function and/or by company divisions.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

You can customize your COA so that the structure reflects the specific needs of your business. You or your accountant will use these account types to create a balance sheet and income statement. The balance sheet includes assets, liabilities, and equity accounts. On the other hand, the income statement includes revenue and expense accounts.

This includes adding accounts specific to your industry or operational needs. Under each main category, create subcategories to further fasb makes a second effort to improve balance sheet debt classification detail the transactions. Ensure that the numbering leaves room for additional accounts to be added as the business grows.