Accounting Tasks Spreadsheet Free Templates and Checklists

Демо-счет на Финам: типы, как открыть и торговать

28 Aprile 2021Drunk Driving: The Dangers Of Alcohol

5 Maggio 2021Accounting Tasks Spreadsheet Free Templates and Checklists

The industry is filled with a wide range of in-demand finance and accounting careers. So whatever type of accounting path you choose, there’s incredible job growth opportunities for accountants. Data from the Bureau of Labor Statistics (BLS) projects that the employment of accountants and auditors will grow 6 percent by 2031. Our analysis of industry trend findings also found that unique accounting job postings have experienced substantial growth. From May 2020 to May 2022, the number of unique accounting-related job postings per month increased by nearly 20,000. Accounting professionals must pay strong attention to detail in order to keep information accurate and organized.

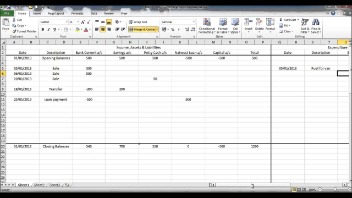

Cash Flow

Bookkeeping is a tactical financial process that includes recording and organizing financial data. That includes what’s being spent and what money the business is making. Accountants go beyond, advising leaders on what to do with this data. A trial balance is a report used to check the balances of all the accounts in my general ledger at a specific point in time.

Accounts payable is money that I owe other people and is considered a liability on my balance sheet. Here’s how that would be recorded in the financial records before that amount is paid out. I wrote this basic accounting guide to ease you into the world of financial management.

Review Employee Timesheets

- Accountants typically have a degree in accounting and don’t necessarily require a license to practice their profession.

- Accounting firms relying on memory alone to keep up with their clients’ accounting tasks risk overlooking essential work assignments or missing critical deadlines.

- Business bank accounts typically charge more than personal accounts and often have a higher minimum balance.

Rather than disappointing your clients, keep your team organized by creating detailed checklists to stay on track. A simple way to do that is with spreadsheets, using Google Sheets or Microsoft Excel. You 215+ amazing fundraising ideas for your organization should have safe channels for transferring these documents so the data is safe from bad actors. If forensics brings up images of NCIS crime scenes, your deductive skills are up to par! Forensic accounting does require a certain degree of digging and detective work.

Review and approve full-year financial reports and tax returns

Garcia stressed that AI will augment, not replace, the work of accountants and also expressed words of caution. Furthermore, accountants are increasingly focusing on a particular vertical or niche to further boost their competitive edge. For instance, accountants may specialize in serving nonprofits, manufacturers, restaurants, or dental offices. One of the last things you’ll do after closing out your books for the year is file forms with the IRS. If you have employees, you’ll need to send them and the IRS W-2 forms.

Note that you may need to make quarterly estimated tax payments if you expect to owe $1,000 or more when filing your annual tax return. Most invoices are due within 30 days, noted as “Net 30” at the bottom of your invoice. Year-end is a busy time for accountants, so here are two of the most important tasks to complete and bring the year to a close. These reports provide information on employee wages, tax withholdings, and other payroll-related details, ensuring compliance with labor and tax laws. This task gives you real-time visibility into how much money is coming in and going out of the business, especially when combined with your cash reconciliation data.

Most accountants are responsible for a wide range of finance-related tasks, either for individual clients or for larger businesses and organizations employing them. Upon first glance, accounting might seem like a fairly straightforward profession—it’s just crunching numbers, right? While it’s true that working with salon getinfo financial data is a substantial part of the job, accounting is a critical business function that involves much more problem solving than you may think.

You can’t evaluate the financial health of your business if your financial systems aren’t operating correctly. No business can operate without sufficient cash inflows each month, and many firms do a poor job of forecasting expected cash flows. Along the lines of automating as much of your accounting as possible, outsourcing your payroll will free up your time and ensure that the process goes smoothly. This may include a bookkeeper and finance professionals, such as a controller, to help with financial analysis.

Your business may need to work with a certain specialty based on their needs. Below, I’ll discuss some common forms of accounting you might encounter. For example, if I’ve recorded various transactions throughout the month, I’ll generate a trial balance to see if the total debits match the total absorption costing total credits. If not, I know I need to investigate and correct any discrepancies before moving forward.

Without these principles, an accountant won’t last long in the field. The IFRS is a set of rules issued by the International Accounting Standards Board. These rules promote consistency and transparency in financial statements. GAAP is a set of standards that accountants must adhere to when they complete financial statements for publicly traded companies in the U.S. As a trusted advisor in an increasingly complex financial landscape, certified public accountants (CPAs) have significant responsibilities for the services they provide to their clients.